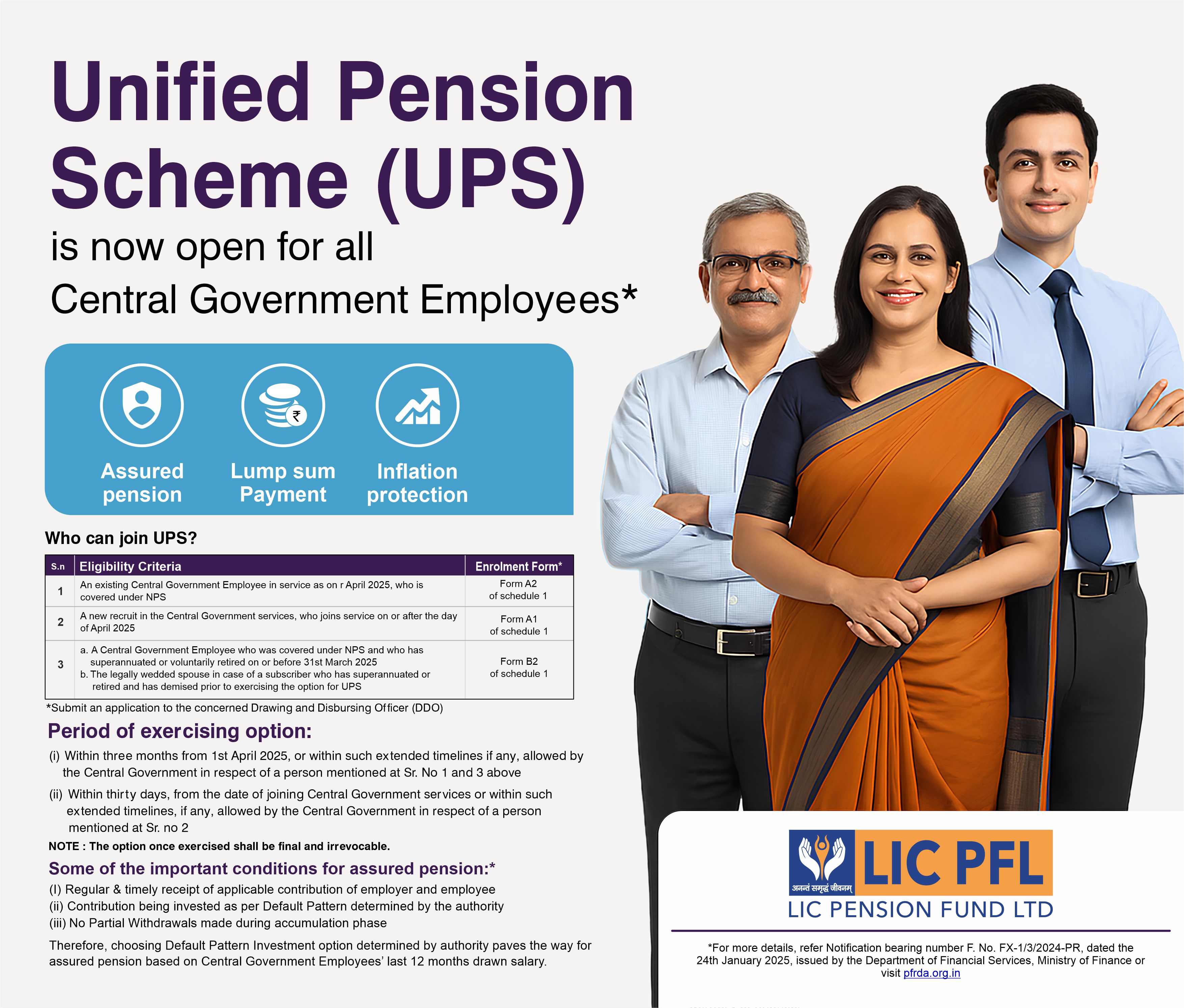

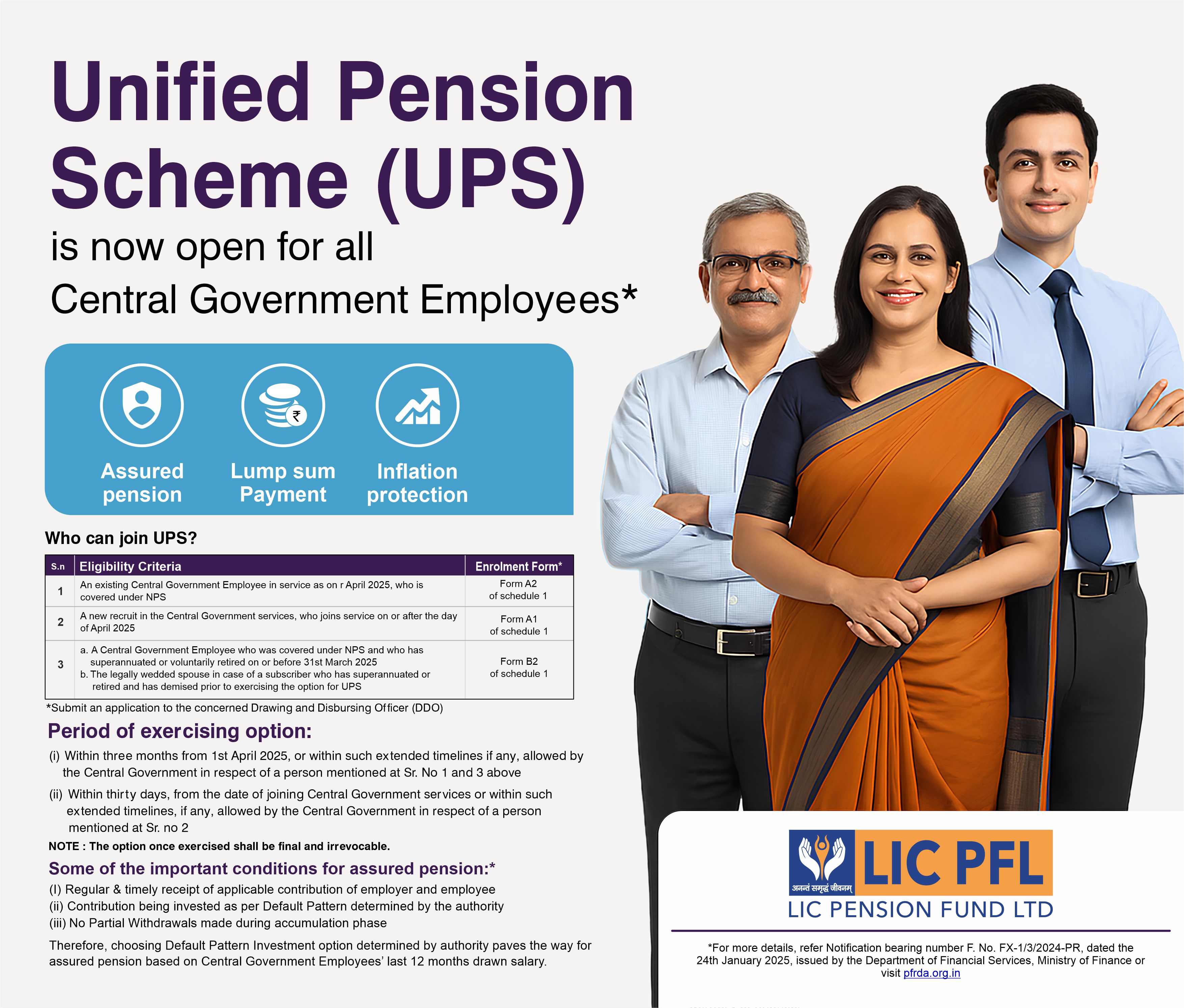

NAV as on 2025-23-Jul : LIC Pension Fund Scheme Central Govt.- 48.2693 LIC Pension Fund SG Scheme State Govt. - 42.9525 NPS LITE -Govt.pattern- 39.9551 LIC Pension Fund Scheme Corporate CG- 31.8633 LIC PENSION FUND SCHEME E - TIER I- 45.5175 LIC PENSION FUND SCHEME C - TIER I- 28.3753 LIC PENSION FUND SCHEME G - TIER I- 30.7676 LIC PENSION FUND SCHEME A - TIER I- 19.5962 LIC PENSION FUND SCHEME E - TIER II- 37.9114 LIC PENSION FUND SCHEME C - TIER II - 26.9191 LIC PENSION FUND SCHEME G - TIER II- 31.3505 LIC PENSION FUND SCHEME A - TIER II- 10 LIC PENSION FUND ATAL PENSION YOJANA SCHEME- 24.6535 LIC PENSION FUND SCHEME TAX SAVER -TIER 2- 14.8532 NPS TRUST-A/C LIC PENSION FUND SCHEME-NPS TIER-II COMPOSITE - 10.9807 LIC Pension Fund - UPS CG Scheme - 10.1808